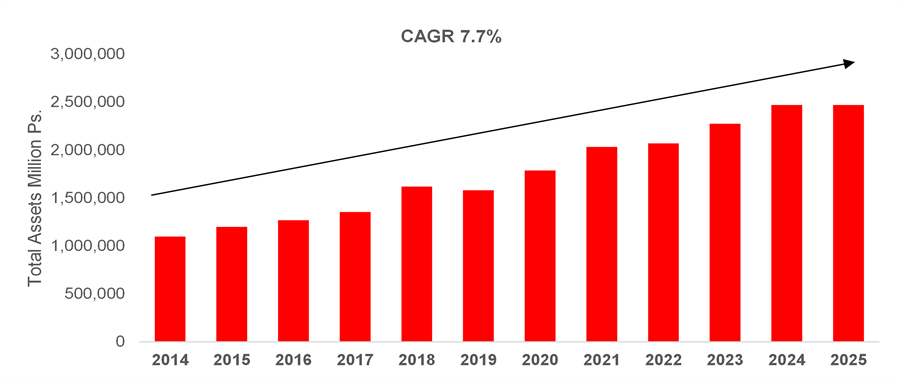

Main growth drivers:

- Initial growth was driven by acquisitions of smaller regional players in order to achieve a nationwide footprint.

- Subsequent growth was still mostly inorganic, acquiring other institutions to become a financial group and achieve revenue diversification.

- From 2014 onwards, growth has been mainly organic, focusing on investing in IT, on executing a customer-centric strategy aimed at improving product quality, customer service and initiatingour digital transformation.

These strategies have helped GFNORTE to become the second largest financial group in Mexico.

Total Assets Growth

Customer Growth

- GFNorte has diversified its customer base, now serving more than 20 million customers across different business lines.

- Through its revenue diversification efforts, GFNorte now concentrates slightly less than 50% of its client base in the bank, and the rest is spread across different businesses:

- Bank: 13,444,635

- Pension Fund (Afore XXI Banorte): 7,958,217

- Insurance: 8,256,137

- Annuities: 228,765

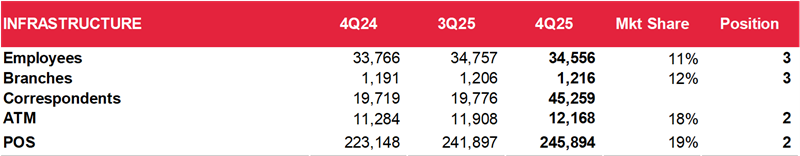

Infrastructure Growth

At Banorte, we strive to serve our customers in the channels of their preference, recognizing the importance of a physical presence nationwide through our branches and ATMs, giving priority to self-service and making it part of our strategy.

Note: Market share in the system. Position figures related to G-7.

Our customer-centric strategy entailed important technological and infrastructure changes for the group, among the most important ones:

GFNorte's Strategic Pillars

Banorte's strategic priority is its customer-centric digital transformation. We are expanding our digital capabilities to drive self-service, enhance customer experience, personalize offers, increase participation, and promote financial inclusion.

In addition, we strive to serve customers wherever they want by providing flexibility in service channels. In particular, we are leveraging web and mobile self-service channels to offer a convenient and accessible experience through digital devices. To achieve all of this, Banorte uses technologies such as artificial intelligence, behavioral analytics, data science, authentication biometrics and cloud-based infrastructure, while ensuring cybersecurity in its processes and channels.

Medium-term strategy

One of Banorte's strategic priorities is the digital transformation, which we use as a pillar of our customer-centric vision. We are focusing on expanding our digital capabilities, placing the customer front and center in our product design, process transformation and innovation, with the goal of continuously improving our self-service experiences and digital interactions; we also want to achieve hyper-personalization in our offerings, increase customer engagement, promote financial inclusion and improve our banking operations, while ensuring cybersecurity in our processes and channels. The latter, leveraging different technological bridges: artificial intelligence, behavioral analytics, data science, authentication biometrics and cloud-based infrastructure.

We start by listening to the voice of our customers to understand their needs and expectations and, thus, initiate the transformation of processes and experiences. A comprehensive transformation built on the talent of the entire organization, which led to the development of a three-pronged strategy:

1) Become a digital bank with branches, accelerating the transformation of the traditional bank, through the new version of the Banorte mobile application, more intuitive and robust, and with our "Bank in minutes" project, customers can contract more products in a matter of minutes, with a fully digital process. We offer comprehensive digital processes for opening accounts, credit cards, payroll loans, mutual funds, insurance, among other products.

2) Form alliances with strategic digital partners such as Apple, Google, Amazon, IBM, Rappi, TuHabi, among others, that allow us to leverage data and information on the daily consumption habits of our customers, to achieve hyper-personalization in our offerings.

3) Create a new fully digital bank, without legacy architecture or technological infrastructure, and that promotes a differentiated culture based on an adaptable, dynamic and flexible operating model. The creation of this digital bank allows us to sustain a multi-segment business model, thus promoting financial inclusion in the country.

Transactional Banking Strategy

Banorte Transactional Banking helps companies in Mexico consolidate their financial strategy and working capital, using advanced technology and a customized approach to facilitate automated collections and payments. Its national presence allows us to be close to our customers using data analytics and artificial intelligence to support digital transformation and decision making.

We are a leader in e-commerce in Mexico offering complete transactional services and payroll solutions, helping to mitigate financial risks and reconcile accounts through our international payments and collections capabilities. We seek agile and efficient transactional solutions, promoting open architecture solutions (universal banking), self-service tools and artificial intelligence. We have the commitment and firm conviction to continue helping companies in Mexico in their development through Banorte Transactional Banking.

Cell work

Thanks to our dynamism in adopting new technologies, we have managed to take the relationship between the client and the institution to the next level, offering memorable experiences and breaking with traditional customs. The latter is possible thanks to the human capital involved in the design and optimization of products and services.

Banorte's work culture, called "cells," gives voice to multidisciplinary teams with extensive knowledge of processes and the ability to make disruptive changes to optimize our operating model. Currently, Banorte has 34 macro cells and 84 cells, working on automating processes, streamlining response times, and reducing operational risk; in other words, improving the customer experience and maintaining the pace and direction of transformation.

Use of Artificial Intelligence with clients

Our customers have experienced the benefits of hyper-personalization through our ability to accurately identify their needs and streamline service. Whether they are applying for a credit card, extending credit, taking advantage of special promotions, seeking payment support or needing more appropriate payment tools, we have ensured that we meet their requirements efficiently.

Thanks to the use of analytics and artificial intelligence, we have created a business and service model centered on our customers' emotions. The hyper-personalization approach has allowed us to have a more successful cross-selling strategy and to develop differentiated products that adapt to the changing needs of our customers.

These actions have been reflected in three key aspects: first, we have succeeded in retaining our customers, which has generated more lasting and profitable relationships; second, we have increased the number of products per customer, which reflects better cross-selling performance; and finally, we have increased our customers' satisfaction, which has translated into an increase in our Net Promoter Score (NPS).

ESG in our decisions

At Banorte, we aim to be the main ally in the decarbonization process of the Mexican economy, we do this by developing innovative solutions tailored to the needs of our customers, in addition, we focus on strengthening our workforce and the communities in which we operate, promoting an inclusive, equitable and diverse culture. We also offer products and services that cater to different demographic segments.

In our organization, sustainability is central to our decision-making, both at the management level and in the Group's overall strategy. This means that we consider environmental, social and governance issues in all our actions, demonstrating our commitment to responsible and sustainable business practices.

Redesigning the branch model

Banorte has significantly transformed the customer experience by implementing technological innovations in its branches. In order to streamline and simplify banking procedures, it is now possible to open personal accounts in just 11 minutes, thanks to digital origination at the branch. This completely digital process incorporates high value and security features for the customer, such as digital biometric signature, 100% digital contracts and biometric identity verification. In addition, new functionalities have been integrated to enable digital sales in less than five minutes, covering products such as insurance, payroll, credit cards, payroll loans and investments.

But the transformation does not stop there. Banorte has introduced mobility in its branches through the use of tablets, which has streamlined the credit placement process, providing an immediate online response to customers' credit applications. In addition, the electronic file has been automatically uploaded, which facilitates document management and ensures greater efficiency in the procedures. As an added value, biometric authorization with fingerprint has been implemented, further improving security and agility in banking operations. Finally, we added scheduled appointments via WhatsApp, a unique service in Mexico that saves time and has been used more than 25 million times so far this year.

Banorte Mobile Renewal

With the Bank in Minutes our mission is to offer quality service to our customers, while guaranteeing security and saving them time, we offer a 100% self-service experience. With the redesign of Banorte Móvil, which has a customer-centric approach, the co-design of experiences between the customer and the bank, and the collaborative work in the cells, together with hard work and dedication, we provide the essential support to make it a more intuitive, easier and faster tool for banking transactions. Among its main functionalities are:

- Apple Pay

- Cardless cash withdrawals at ATMs

- Credit card delivery tracking

- Banking inquiries

- Online product purchase module

As of August 2022, "Maya", the virtual assistant was incorporated into Banorte's mobile application, which handles approximately 28,000 transactions and more than 550,000 conversations with customers per month. Maya's functions include balance inquiries, account information, transfers, TDC payments, among other functions, with a satisfaction level of 80.9%.

Financial goals for the next 5 years

In 2023, Banorte presented its goals for the next five years during the "Banorte Day" event. During this event, the Group's long-term strategic vision was emphasized, highlighting the strengths that support the sustainability of its business model and profitability indicators. Technological capabilities, hyper-personalization and the exploitation of nearshoring opportunities were highlighted as key competitive advantages in the market.

GFNorte 5-year Forecast*

*Disclaimer