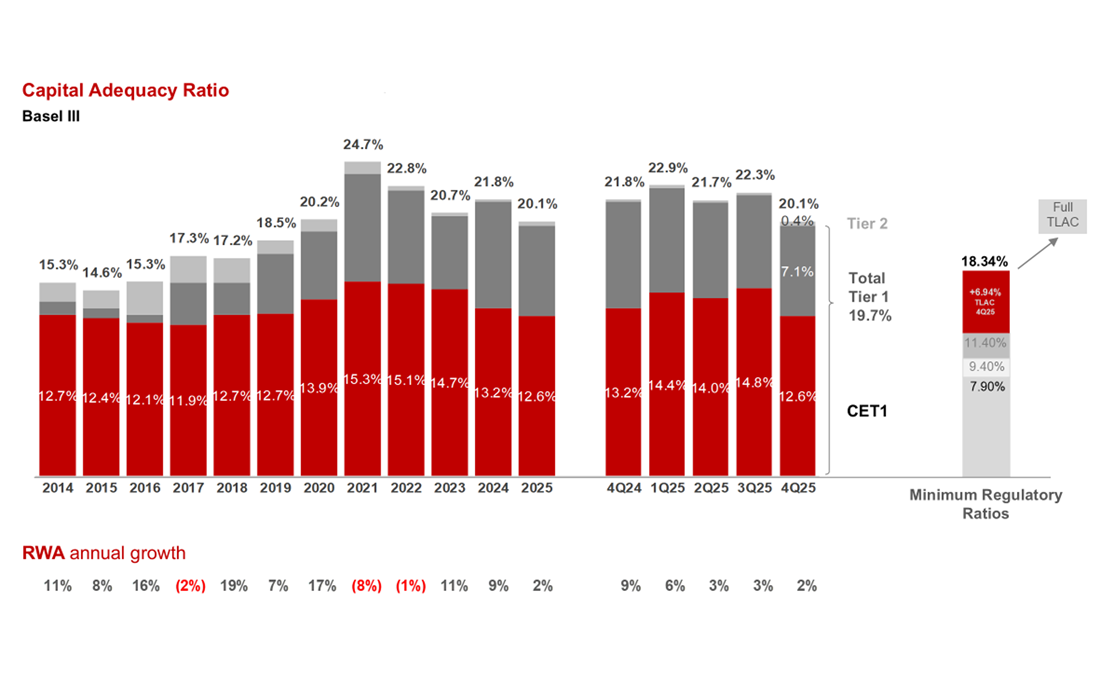

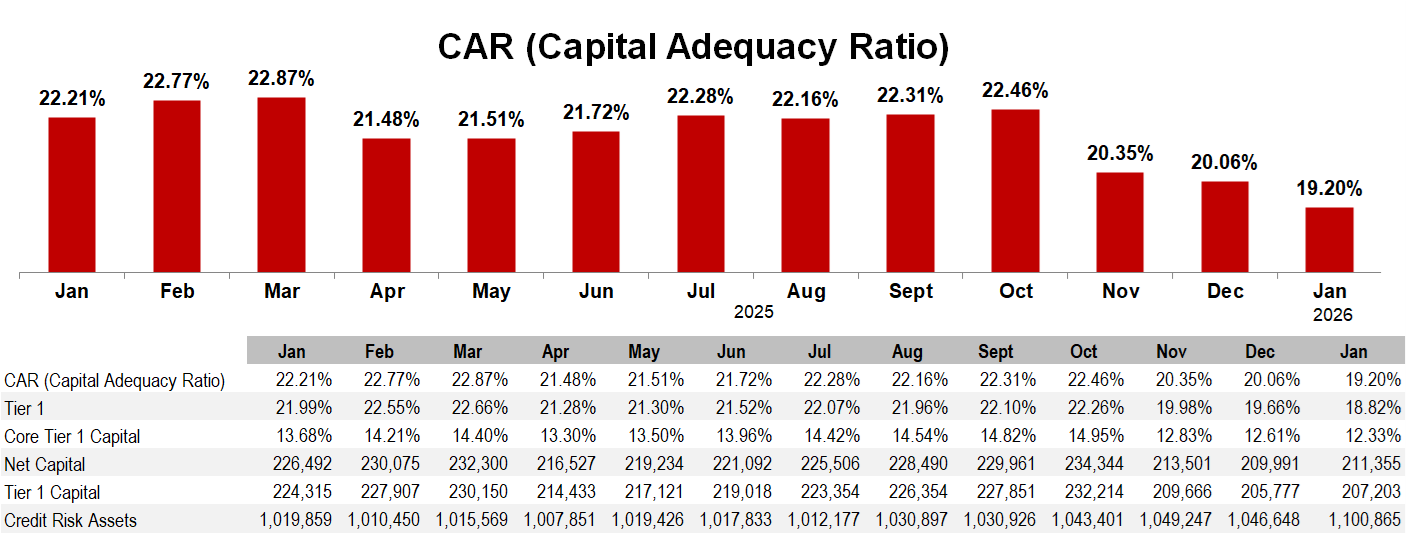

Banco Mercantil del Norte (Banorte)

Banorte has fully adopted the capitalization requirements established to date by Mexican authorities and international standards, so-called Basel III, which came into effect in January 2013.

In 2025, Banorte was confirmed as a Level II – Systemically Important Financial Institution, which implies that Banorte must maintain a 0.90 pp capital buffer. Additionally, it must comply with an additional net capital supplement (TLAC), which as of the end of 2025 amounts to 6.94 pp, in accordance with current regulations. Consequently, as of December 2025, the minimum Capital Adequacy Ratio for Banorte stands at 18.34%. Meanwhile, the minimum Core Equity Tier 1 (CET1) is 7.9%.

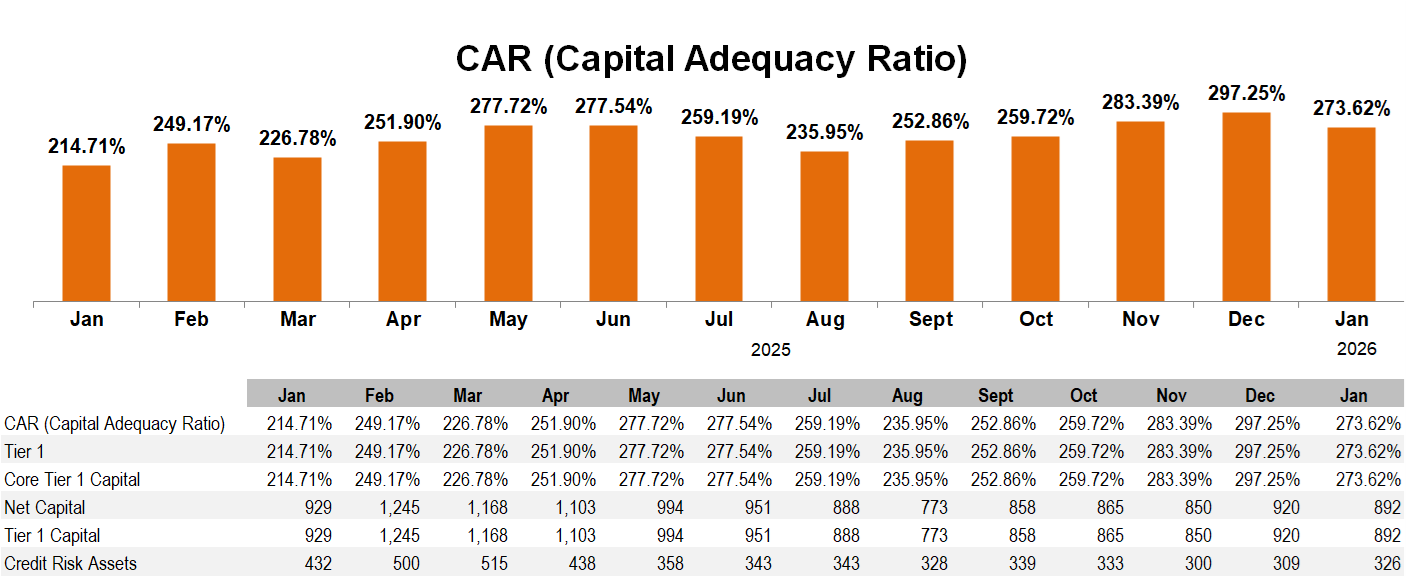

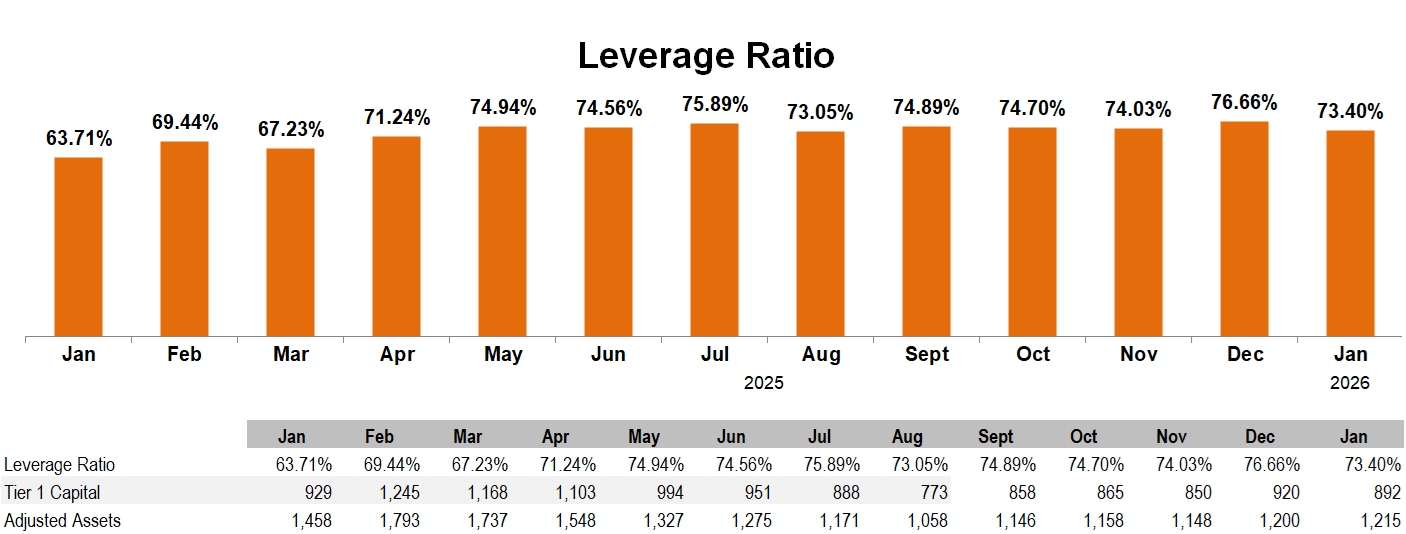

Bineo

Bineo has fully adopted the capital requirements established to date by Mexican authorities and international standards, so-called Basel III, which came into effect in January 2013.

The minimum Capital Adequacy Ratio required for Bineo amounted to 10.50%, which includes a minimum requirement of Core Equity Tier 1 (CET1) of 7.00%.