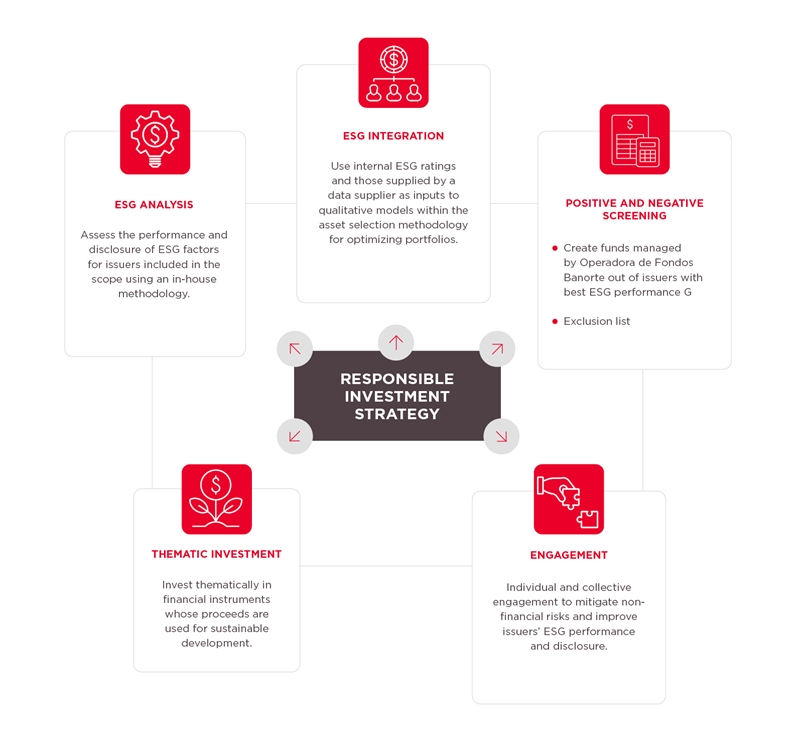

ESG Analysis

ESG Assessment of Equity Instruments

We have an internal methodology for the ESG assessment of equity instruments, based on an analysis of the transparency of ESG factors of the issuers that make up each of Operadora de Fondos portfolios, as well as a reputational risk evaluation of these issuers. Below are some of the criteria we consider important for each factor:

ESG Assessment of Fixed-Income Instruments

On the other hand, our internal methodology for the ESG assessment of fixed-income instruments evaluates the ESG profile of issuers using our methodology for equity assets, as well as the key criteria and components of labeled bonds, in accordance with the corresponding Principles established by the International Capital Market Association (ICMA). Based on the results obtained, we seek to reach agreements with issuers to improve their ESG performance.

ESG Integration

We incorporate Environmental, Social, and Corporate Governance (ESG) factors into investment processes, as they are fundamental for investment decision-making, representing risks or opportunities for the financial sector.

Positive and Negative Screening

Likewise, within the product offering managed by Operadora de Fondos Banorte, we offer a relative management equity fund, whose investment strategy is generated through a quantitative model that, among other factors, uses ESG factors within a positive screening process.

Thematic Investment

We participate in thematic investments in financial instruments whose resources contribute to sustainable development, such as bonds, investment funds, and labeled ETFs.

Active Ownership

We establish relationships with the companies in which we invest by initiating dialogues and establishing bilateral commitments. These efforts aim to enhance performance and increase transparency regarding ESG factors, enabling us to jointly advance the sustainability agenda.

Additionally, we seize opportunities for collective engagement aligned with the focus of our strategy, adding value to our individual engagements. In this regard, as investor signatories of the Carbon Disclosure Project (CDP), we participate in the collective engagement campaigns promoted by this initiative.