Materiality is an essential component for the definition of the sustainability strategy since it allows the detection of environmental, social and economic risks, which in turn triggers the alignment of the organization's strategy to the factors of greatest impact and interest; generate action plans and performance indicators and report and communicate progress in ESG based on the relevant topics that make up the matrix.

Thereby, during 2020, our materiality matrix will follow the recommendations for the identification and prioritization of material issues raised by the Global Reporting Initiative (GRI), and according to the perspective of our leaders, as well as stakeholders.

1. Process to establish the material issues

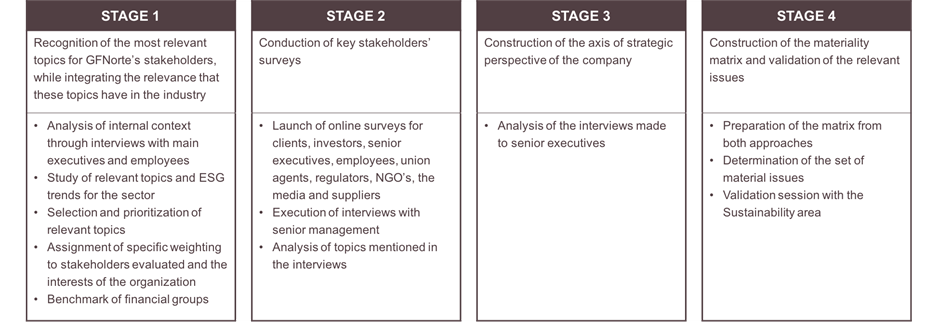

Hereby, we present the different activities carried out during the materiality update process:

2. Materiality issues

We identified 18 material issues, which are distributed in the four pillars of our Sustainability Model.

ENVIRONMENTAL ISSUES

Climate change

Vulnerability and adaptation of the Group to physical and transition risks derived from climate change.

Operational eco-efficiency

Management, monitoring and environmental performance in terms of energy, emissions, waste and water.

Environmental culture

Training and raising awareness about the impact generated on the environment, inside and outside the Group.

SOCIAL ISSUES

Human rights

Policies, initiatives and processes that guarantee respect and non-violation of universal human rights, as well as non-discrimination and inclusion of vulnerable groups.

Education and financial inclusion

Training and relevant information on financial products and services for making informed decisions, as well as providing people with access to useful and affordable financial services to improve the quality of life.

Diversity and inclusion

Policies, initiatives and processes to guarantee equity in opportunities for all stakeholders.

Human capital

Policies, initiatives and processes aimed at the well-being of employees; training and development, occupational health and safety and measures to improve the attraction and retention of talent.

Corporate citizenship

The Group's contribution to society through philanthropic and volunteer activities with a business-aligned approach.

GOVERNANCE ISSUES

Corporate governance

Standards and practices related to the structure and processes of the Group's governing bodies for decision-making and definition of strategies.

Relationship with stakeholders

Mechanisms to identify and respond to the needs and expectations of all those with whom the Group is related (organizations, entities, groups and individuals).

Ethics and accountability

Standards and practices established in the Group's code of conduct, as well as anti-corruption, prevention of money laundering and economic competition, prioritizing transparency.

Risk management

Administration, monitoring and reporting of risks (economic, social and environmental) of the operation, to guarantee business continuity.

Technology and innovation

Development and transformation of processes, competencies, models, products and services to make the most of digital capabilities within organizational and business activities.

Data security

Policies, initiatives and processes for the management of risks associated with the continuity of the operation, data protection and cybersecurity.

SUSTAINABLE FINANCE ISSUES

Management of socio-environmental risks in financing

Policies, initiatives and processes for managing risks and socio-environmental impacts of the activities we finance in order to avoid exposure to credit, market, legal, operational and reputational risks.

Responsible investment

Policies, initiatives and processes for the incorporation of environmental, social and governance (ESG) factors in investment decision-making for the construction of portfolios.

Sustainable insurance

Policies, initiatives and processes for managing and monitoring the risks and opportunities associated with environmental, social and governance (ESG) issues in the insurance value chain, with the aim of reducing risk and developing innovative solutions.

Sustainable financial products

Development and offering of financial products that provide benefits to clients that have the best environmental, social and governance (ESG) practices, with the intention of contributing to the consolidation of a sustainable economic environment.

3. Materiality Matrix

4. Alignment with the Sustainable Development Goals (SDG) and Principles for Responsible Banking (PRB)

Click here

5. Sustainable Model

Our Sustainability Model is aligned to the materiality matrix. In this sense, it considers the three fundamental pillars: Environmental, Social and Governance, which in turn converge in a central pillar called Sustainable Finance.