Social and Environmental Risk Management

For Banorte, taking environmental and social risks into account in decision-making is essential for achieving a resilient future in light of climate change, biodiversity loss and social inequality. For this reason, preventing and managing this type of risk is a priority for our business processes and our stakeholders.

Since 2012 we have developed a Socio-Environmental Risk Management System (SEMS) and we adhere to the Equator Principles, being the second Mexican bank to adopt this framework in the country, committing ourselves to promoting and granting financing to clients that develop socially and environmentally responsible projects. in compliance with the law and applying the best practices in the sector.

The SEMS was established to identify, categorize, evaluate and to manage the risks and impacts of the financing we provide in Corporate, Commercial and Infrastructure banking; is an integral part of the bank's credit process and is based on the national legal framework, institutional regulations, and the Equator Principles, which is the highest standard for risk management in the financial sector.

During the analysis, we identify the impacts generated by the financings and the risky or prohibited activities with the support of our exclusion list. We classify financings into categories A (high risk), B (medium risk) or C (low risk), based on the magnitude of their impacts and their possibility of mitigation.

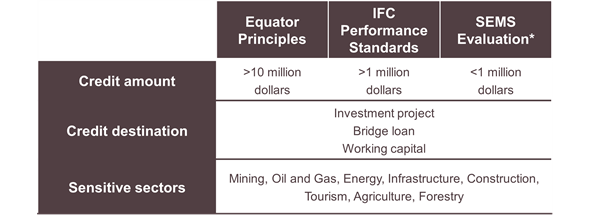

Subsequently, we evaluate the financing under the guidelines of the Equator Principles, the IFC Performance Standards and the internal SEMS evaluation. Finally, we periodically monitor the projects, providing advice to clients and making site visits.

*SEMS evaluation represents the third evaluation framework created for credits less than 1 million dollars. Its objective is to analyze the most relevant environmental, social and reputational impacts of credits and its compliance with the current national legislation and international guidelines.

The risk analysis concludes with the preparation of a Due Diligence, the results of which are communicated to the Credit Committees so that they consider the recommendations and conditions established by the Social and Environmental Risk Area, within the making of financing decisions.

For more information, consult our Socio-Environmental Risk Policy, the Equator Principles reports or send an email to [email protected]

Sustainable financial products

As part of our offer, we have sustainable instruments and products aimed at meeting the needs and interests of our clients and society.

LOANS

Sustainable taxonomy

In 2018 we created our own taxonomy which defines 91 codes of sustainable sector activity that allow us to identify sustainable projects financed mainly in Corporate Banking and Commercial Banking. In this way, we have determined our climate portfolio, which in 2018 and 2019 included projects from the renewable energy, waste and recycling, water treatment and sustainable agriculture sectors.

SME eco-loans

We are one of the first financial institutions in the country that is interested in energy efficiency programs, supporting micro, small and medium-sized enterprises, as well as individuals within the business activity regime, with financing needs for energy efficiency projects and/or renewable energies, for the acquisition and/or replacement of equipment and the expenses derived from its installation, as well as for the acquisition and installation of interconnected photovoltaic solar systems under the distributed clean generation scheme.

For more information about the product, please check this link.

Green Car Loan "Autoestrene Verde Banorte"

Aimed at individuals, individuals with a business activity, and companies who wish to acquire a new or semi-new hybrid or electric car. This product provides benefits such as attractive fixed rates, flexible terms, special damage insurance rates with Seguros Banorte, support in financing the auto insurance and the life insurance, prepayments without penalties and financing up to 90%.of the total value of the invoice, including VAT.

For more information about the product, please check this link.

THEMATIC BONDS

Investment

We are committed to sustainable investment and supporting the transition to a low-carbon economy. Accordingly, we have been an active investor in the young market for local green, social and sustainable bonds.

Placement

Through the Investment Banking area of Casa de Bolsa Banorte Ixe, we have participated as placement intermediaries, providing advice and distributing the instrument in the market with investors.

Issuance

We have a Sustainable Finance Framework aligned with the best market practices which dictates the general guidelines so that we can issue green bonds. The document has a favorable Second Party Opinion issued by Sustainalytics.

Advice

Through the Corporate Debt Analysis area, we published a “Green Bonds Tutorial - A new era for the bond market” whose objective is to explain to market participants the essential characteristics of green bonds as issuers. In addition, the evolution of this type of instrument at the international level and the efforts that have been carried out so far in the national market are described, with the opportunities and implicit benefits for issuers and investors..

Sustainable insurance

We understand that the impacts derived from physical risks of climate change are becoming more frequent and severe. That is why, as part of the services we offer through our subsidiary Seguros Banorte, we have the following products:

Hydrometeorological insurance

Catastrophic coverage for hydrometeorological phenomena, which are partly associated with the effects of climate change such as frost, floods, hurricanes, among others. Applies to residential, commercial and industrial insurance.

Parametric insurance

Insurance with coverage against hurricanes that has payment detonation parameters established by the trajectory and speed of the wind, staggered to 100, 130 and 160 knots, with which the maximum limit of liability (LMR) varies. The rating of the parameters is established based on the official registry of the National Hurricane Center of the National Oceanic and Atmospheric Administration (NHC-NOAA).

When an event occurs and enters any of the predefined parameters, the commitment is to make the payment within 72 hours at the latest, regardless of whether or not there are damages in the insured area. This guarantees that the impacts on the infrastructure and on the natural capital of the delimited area can be addressed as soon as possible.